Articles

Aliens who’ve dual desert treasure 2 login uk position would be to come across section six to possess information for the filing a profit to possess a dual-status taxation year. You ought to earliest determine whether, for tax intentions, you’re a nonresident alien or a resident alien. Progress costs of your superior income tax credit might have been produced to the health insurer to simply help buy the insurance coverage of you, your spouse, otherwise your own centered.

When you are an employee and you also discover earnings susceptible to U.S. taxation withholding, you must fundamentally file by the 15th day of the brand new last week immediately after your own income tax season ends. For many who file for the new 2024 twelve months, your own get back arrives April 15, 2025. People paid to arrange tax returns for other people need an excellent comprehensive knowledge of tax matters. For additional info on how to choose an income tax preparer, go to Methods for Going for an income tax Preparer to your Internal revenue service.gov.. Citizen aliens will get be eligible for taxation pact professionals on the items chatted about below. You could potentially generally program to have withholding taxation shorter or eliminated for the wages or any other income that will be entitled to income tax treaty pros.

Desert treasure 2 login uk: Taxation Implications of Shelter Dumps

While you are in one of these types of classes plus don’t have to get a cruising or departure permit, you need to be capable service your own claim to have exemption which have correct identity otherwise give the power for the exception. While you are expected to report the fresh treaty benefits however, perform perhaps not, you are subject to a punishment away from $1,000 per incapacity. Generally, the newest teacher otherwise professor should be in the united states primarily to coach, lecture, show, otherwise participate in search. A hefty section of one to individuals date need to be based on those individuals obligations. You’re susceptible to a penalty to have underpayment away from payments from estimated tax but in certain situations.

Of the $75,100000, $several,five-hundred ($75,one hundred thousand × 30/180) is actually U.S. resource money. If you are a member of staff and found compensation to own labor or private services performed both inside and out the us, special regulations apply within the determining the main cause of your compensation. Payment (besides specific edge advantages) try sourced to your a period foundation. Certain fringe advantages (such houses and you can training) try acquired to your a geographical basis. For more information, come across Genuine People from Western Samoa otherwise Puerto Rico in the part 5. If you aren’t required to document money, post the newest statement to the pursuing the address.

John gone back to the usa to your Oct 5, 2024, while the a legal long lasting resident. John turned into a citizen before the intimate of your third schedule season (2024) beginning following the stop from John’s first age house (August step one, 2021). For this reason, John is actually at the mercy of taxation under the special laws to your chronilogical age of nonresidence (August 2, 2021, because of October 4, 2024) if it’s more than the fresh tax who would usually implement so you can John because the an excellent nonresident alien. As of October step 1, 2023, Connecticut assets executives must return citizens’ security deposits in this 21 months unlike thirty days.

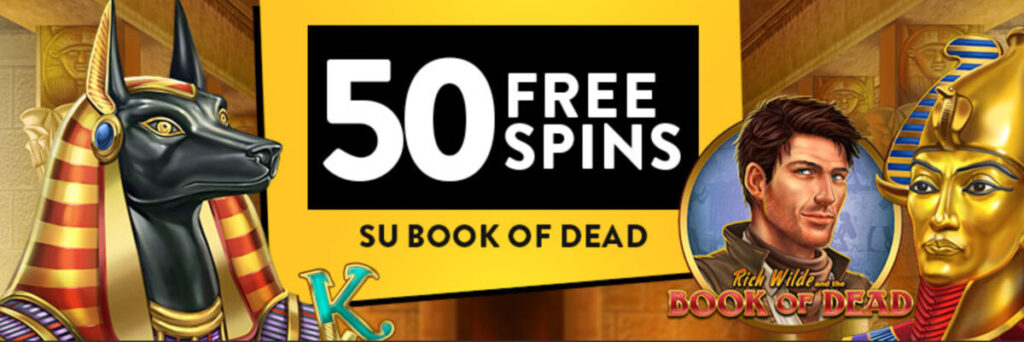

$5 Minimum Put Gambling establishment NZ – Deposit 5 get one hundred free revolves

For many who declaration income to your a calendar year foundation and you also lack earnings subject to withholding to own 2024, file your own come back and you may spend your taxation because of the June 16, 2025. You must and make your very first payment away from projected tax to own 2025 because of the June 16, 2025. You can’t file a joint tax get back or generate joint costs of estimated income tax. Although not, when you are partnered so you can a good You.S. citizen otherwise resident, come across Nonresident Mate Treated because the a citizen within the chapter step one. To possess information about how to figure the fresh special tax, see Expatriation Tax, after. You’re usually engaged in a good U.S. change or business after you manage individual functions in the Joined Says.

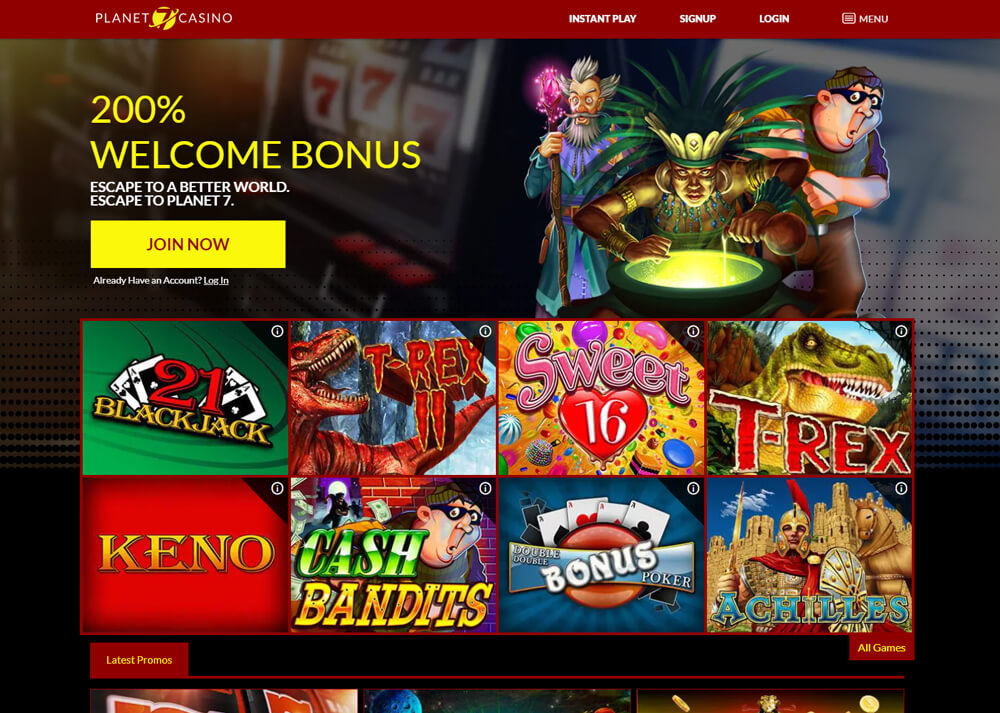

How to put currency which have an online bank

- We have been an economic features system for possessions professionals and you can residents.

- While you are in just one of such groups and do not have to get a sailing otherwise deviation permit, you really must be able to help your allege to have different with proper identification otherwise allow the power for the exception.

- You’re capable choose to remove all the money away from real property because the effortlessly linked.

You’re an LTR if perhaps you were a legitimate long lasting citizen of your All of us in the at least 8 of one’s last 15 income tax ages stop for the 12 months your own abode closes. Within the deciding for those who meet the 8-seasons demands, don’t count people 12 months that you’re treated as the a good citizen of a different nation below a tax pact and you will manage perhaps not waive treaty advantages. These laws and regulations apply only to those financing growth and you can losses out of offer in the united states which are not effortlessly related to a swap or business in america. It implement even though you is engaged in a trade or business in the united states. Such laws and regulations don’t apply at the brand new sales otherwise exchange out of an excellent U.S. real property desire or even the newest sale of any property one to is efficiently related to a swap otherwise business on the Joined Says.

Pay U.S. expenses on the run

You might deduct their charitable efforts or gift ideas so you can qualified teams subject to specific restrictions. Certified organizations were groups which might be spiritual, charity, educational, medical, or literary in the wild, or that really work to avoid cruelty so you can students or pet. Specific groups you to render federal or around the world amateur football competition try and certified teams. The newest deduction to own moving expenses is available if you are a member of one’s You.S. Armed forces on the effective duty and, because of an armed forces order, your disperse because of a permanent transform of station. For individuals who meet the requirements, fool around with Function 3903 to find extent to deduct.

Interac and Instadebit is actually one another bank import choices that will be extremely popular inside the Canada on account of just how simple he’s to use. They each link to your bank account to make you build casino transactions and no lowest, that is best for investing in small deposits. Withdrawal times try small also, as well as the charge is actually very practical because of the top-notch services they provide.

For many who obtained a reimbursement otherwise discount within the 2024 from fees your paid-in an early on seasons, do not reduce your deduction by you to definitely amount. Rather, you need to through the refund or discount inside the earnings for individuals who deducted the fresh fees in the last season and the deduction reduced your own tax. 525 to have home elevators simple tips to contour extent to add inside the money. Your own submitting position is important in deciding if or not you can bring certain deductions and loans. The guidelines to own choosing their processing status will vary to possess citizen aliens and you can nonresident aliens.

Juan returned to the newest Philippines for the December step one and returned to the United states to the December 17, 2024. While in the 2025, Juan is a resident of your United states beneath the nice presence try. If the Juan makes the basic-seasons possibilities, Juan’s abode performing go out was November step 1, 2024.

Shelter put legislation the occupant should be aware of

This also applies to REMICs which can be susceptible to a yearly $800 income tax. California Disclosure Loans – Should your fiduciary is employed in a great reportable deal, as well as an excellent noted exchange, the fresh fiduciary could have a great revelation specifications. Mount the brand new federal Setting 8886, Reportable Transaction Disclosure Report, for the straight back of the Ca come back and any supporting times.